13 Michigan Property Types Predicted To See Price Drops In 2026

As homebuyers refine their expectations, certain property types that once attracted attention are starting to lose their shine.

Michigan’s housing landscape is evolving as energy efficiency, walkability, and modern, move-in-ready spaces increasingly take priority.

No longer is bigger always better – buyers are seeking homes that align with their lifestyles and values.

From sprawling suburban estates to outdated homes, properties that once commanded high prices are now facing market shifts.

As preferences change and economic realities take hold, Michigan’s housing market is set to see certain categories experience price reductions.

1. Oversized Suburban McMansions

Sprawling homes with five or six bedrooms and formal dining rooms don’t hold the same charm they once did.

Modern families tend to prioritize cozy, functional layouts over square footage that goes unused.

Energy bills for these oversized properties can climb quickly, especially during Michigan’s cold winters, making them less appealing to budget-conscious buyers.

Maintaining large yards and multiple living spaces requires time and money that many homeowners would rather spend elsewhere.

Buyers today often prefer homes that feel warm and manageable rather than grand and impersonal.

Properties with excessive space are sitting on the market longer, and sellers may need to adjust their expectations.

Downsizing trends and the rising cost of utilities are pushing these McMansions toward price reductions.

Homes designed for a different era are struggling to compete with efficient, thoughtfully designed alternatives that match today’s lifestyle needs.

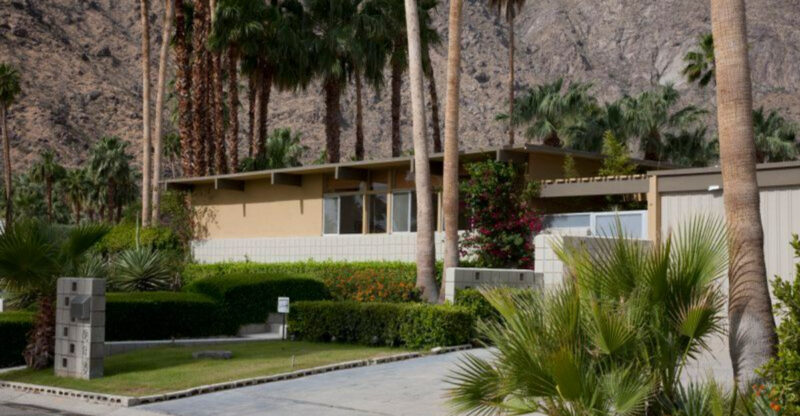

2. Outdated Ranch Homes Without Updates

Ranch homes stuck in the 1970s with original kitchens and shag carpeting face a tough market.

Buyers shopping for homes today expect updated finishes, modern appliances, and spaces that feel fresh and clean.

Renovation costs for these properties can easily climb into the tens of thousands, which scares off many potential buyers who want something move-in ready.

Outdated electrical systems, single-pane windows, and old HVAC units add to the list of concerns.

Sellers hoping to attract interest may find themselves waiting months for offers, and those offers often come in below asking price.

Younger buyers especially tend to avoid homes that require immediate work, preferring properties where they can settle in without major projects.

The charm of mid-century design doesn’t always translate when paired with worn-out materials and outdated layouts.

Price cuts may become necessary to compete with renovated homes in similar neighborhoods.

3. Remote Rural Properties Far From Cities

Properties located miles from the nearest city used to appeal to remote workers seeking peace and space.

As companies call employees back to offices, long commutes are becoming less tolerable, and rural isolation feels more like a burden than a benefit.

Gas prices and vehicle wear add up quickly when the nearest grocery store is a thirty-minute drive.

Limited access to healthcare, entertainment, and dining options makes these homes harder to sell, especially to younger families.

Internet connectivity can also be spotty in rural areas, which poses challenges for anyone working from home even part-time.

Buyers today often prioritize convenience and community over acreage and solitude.

Homes far from urban centers are seeing fewer showings and longer market times.

Sellers may need to lower prices to attract buyers willing to trade convenience for space and quiet.

4. Condos With High Association Fees

Monthly HOA fees that rival mortgage payments can quickly turn buyers away from condo living.

When association dues climb above a few hundred dollars without offering pools, gyms, or other desirable amenities, the value proposition disappears.

Buyers doing the math realize they could afford a single-family home for the same monthly cost, complete with privacy and no shared walls.

High fees also raise red flags about the financial health of the association, leading cautious buyers to look elsewhere.

Special assessments for building repairs can add unexpected costs that make ownership feel risky.

Condos that once appealed to first-time buyers or downsizers are losing ground as fees continue to rise.

Sellers may struggle to justify the price when buyers see limited benefits for the ongoing expense.

Price reductions may become necessary to offset the burden of high association costs and attract hesitant buyers.

5. Homes Near Closed Manufacturing Plants

Shuttered factories cast a long shadow over nearby neighborhoods, affecting property values and community morale.

Job losses from plant closures mean fewer people with stable incomes looking to buy homes in the area.

Concerns about soil contamination or air quality linger even after a factory closes, making buyers nervous about long-term health risks.

Abandoned industrial buildings can become eyesores, attracting vandalism and lowering the overall appeal of the neighborhood.

Local tax bases shrink when major employers leave, which can lead to reduced funding for schools and public services.

Buyers often avoid these areas unless prices drop significantly to offset the perceived risks and lack of economic opportunity.

Homes that were once solid middle-class investments are now harder to sell at previous market rates.

Sellers may need to accept lower offers to compete with properties in more vibrant, economically stable communities across Michigan.

6. Investment Properties In Oversaturated Rental Markets

Too many rental properties in one area can flood the market and drive down both rents and property values.

Cities like Lansing and Kalamazoo have seen a surge in investor-owned properties, leading to increased vacancy rates and competition for tenants.

When rental income drops, the return on investment shrinks, making these properties less attractive to buyers.

Oversaturation also tends to attract tenants with fewer options, which can sometimes lead to higher turnover and maintenance costs.

Investors who bought expecting steady cash flow are finding the reality more challenging as the market shifts.

Properties that were profitable a few years ago may now struggle to cover mortgage payments and expenses.

Buyers looking at investment opportunities are becoming more cautious, demanding lower purchase prices to justify the risk.

Sellers may need to reduce asking prices to move properties in markets where rental demand has softened and competition remains high.

7. Luxury Homes In Declining School Districts

Families shopping for high-end homes often put school quality at the top of their priority list.

When test scores drop and programs get cut, even beautiful properties in desirable neighborhoods lose their appeal to buyers with children.

Parents are willing to pay premium prices for homes in top-rated districts, but that premium evaporates when schools struggle.

Luxury homes in areas with declining educational performance sit on the market longer, as families look elsewhere for better opportunities.

Retirees and empty nesters might not care about schools, but they represent a smaller pool of potential buyers.

Sellers hoping to attract families with children face an uphill battle when nearby districts are losing funding and reputation.

The mismatch between home quality and school performance creates a gap that price reductions often need to fill.

Buyers expect discounts to offset the perceived disadvantage of weaker schools, putting downward pressure on luxury home values in affected areas.

8. Lakefront Properties With Erosion Issues

Owning a home on the water sounds idyllic until erosion threatens the shoreline and property value.

Climate change has intensified Great Lakes water levels and storm activity, causing beaches to wash away and bluffs to crumble.

Fixing erosion problems can cost tens of thousands of dollars, and some properties face ongoing battles that never fully resolve.

Insurance companies are becoming more cautious about covering homes at risk, which adds another layer of concern for potential buyers.

What was once a premium feature – direct water access – can become a liability when the land beneath the home is literally disappearing.

Buyers are starting to weigh the risks more carefully, especially when they see neighboring properties struggling with the same issues.

Lakefront homes with visible erosion are sitting on the market longer and receiving lower offers.

Price cuts may be necessary to compensate for the uncertainty and expense tied to shoreline instability.

9. Single-Family Homes Converted to Rentals

Neighborhoods with too many rental properties can lose the sense of community that makes them attractive to buyers.

When homeownership rates drop and rentals dominate a street, property maintenance sometimes declines, and the neighborhood character shifts.

Buyers looking for stable, long-term communities often avoid areas where most homes are tenant-occupied.

High rental concentration can also signal economic challenges or declining desirability, which further discourages potential buyers.

Lenders may become more cautious about financing purchases in neighborhoods with low owner-occupancy rates.

Families seeking a quiet, well-kept street with engaged neighbors may pass over areas where rental turnover is high.

Properties in these neighborhoods face stiffer competition and longer market times.

Sellers may need to lower prices to attract buyers willing to take a chance on a block where rentals outnumber owner-occupied homes and community stability feels uncertain.

10. Properties With Outdated Heating Systems

Michigan winters are no joke, and an old furnace can mean sky-high energy bills and unreliable heat.

Buyers are increasingly aware of the costs associated with replacing outdated heating systems, which can run several thousand dollars.

Homes with original equipment from the 1980s or 1990s raise immediate red flags during inspections.

Energy efficiency is a major selling point today, and properties with inefficient systems struggle to compete with homes featuring modern HVAC upgrades.

Buyers often factor replacement costs into their offers, which means sellers receive less than they hoped.

Cold spots, uneven heating, and frequent repairs make these homes less appealing, especially to first-time buyers on tight budgets.

Sellers who haven’t upgraded their systems may face extended market times and lower offers.

Price reductions can help offset the perceived expense and risk, making the property more attractive to buyers willing to take on the heating system upgrade themselves.

11. Fixer-Uppers In Competitive Neighborhoods

Desirable neighborhoods attract buyers who want to move in and enjoy their homes immediately, not tackle renovation projects.

Fixer-uppers require time, money, and expertise that many buyers simply don’t have or want to invest.

In competitive markets, updated homes sell quickly, while properties needing work linger on the market despite their good locations.

Buyers often overestimate renovation costs and underestimate the hassle, leading them to choose turnkey options instead.

Financing can also be trickier for homes needing significant repairs, which narrows the pool of potential buyers.

Even in sought-after areas, properties with peeling paint, outdated bathrooms, and worn floors struggle to attract offers at full price.

Sellers hoping to capitalize on neighborhood desirability may find that condition matters more than location.

Price cuts become necessary to compensate for the work required and to compete with move-in-ready homes that command premium prices in the same area.

12. Aging Mobile Homes In Dated Parks

Mobile homes can offer affordable housing, but aging units in outdated parks face significant challenges.

Older manufactured homes often lack the insulation and build quality of newer models, leading to high heating costs and maintenance issues.

Parks with aging infrastructure, limited amenities, and strict lot rent increases can deter buyers looking for value.

Financing options for older mobile homes are more limited, which shrinks the buyer pool and affects resale values.

Buyers also worry about the long-term viability of parks that show signs of neglect or financial trouble.

Lot rent that climbs steadily can make ownership feel less affordable over time, even if the home purchase price is low.

Homes in parks with poor reputations or declining conditions struggle to attract serious offers.

Sellers may need to accept lower prices to move properties in parks that lack modern amenities and face ongoing maintenance concerns that buyers view as red flags.

13. Homes With Extensive Deferred Maintenance

Properties with years of neglected repairs can overwhelm even the most optimistic buyers.

Deferred maintenance adds up quickly, from leaking roofs and cracked foundations to outdated plumbing and electrical systems that need replacement.

Buyers conducting inspections often uncover layers of issues that turn excitement into caution.

Lenders may hesitate to finance homes with significant maintenance problems, which limits the pool of potential buyers to those paying cash.

Sellers who put off repairs hoping to avoid the expense often end up losing more in the form of price reductions.

Homes showing visible neglect send a message that other hidden problems may lurk beneath the surface.

Buyers factor in the cost and stress of bringing a property up to standard, which directly impacts their offers.

Price cuts become necessary to offset the work required and to attract buyers willing to take on the challenge of restoring a home that’s been neglected for too long.