14 Illinois Home Types Predicted To Lose Value By 2026 And Why

Illinois real estate is changing fast, and not all homes will keep their value as we approach 2026.

Whether you’re thinking about buying, selling, or just curious about the market, understanding which property types might lose value can save you thousands of dollars.

I’m here to walk you through 14 specific home types across Illinois that experts predict will struggle in the coming years, so you can make smarter decisions about your biggest investment.

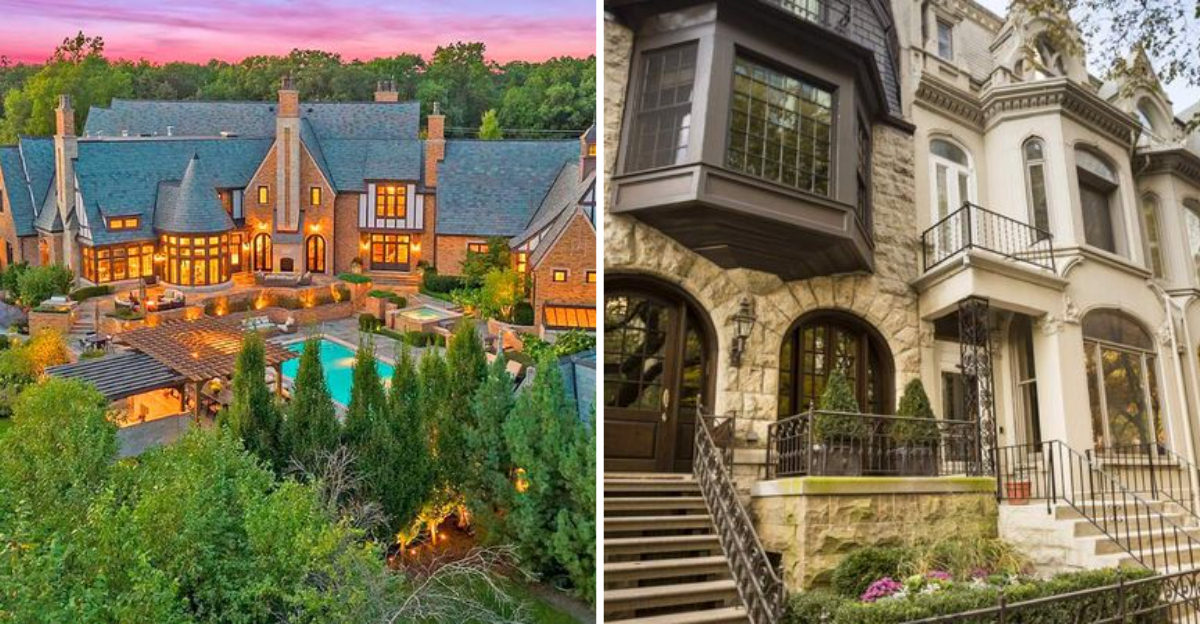

1. McMansions in Suburban Chicago

If you’ve noticed those giant homes with mismatched architectural styles, you’re looking at what many call McMansions. These oversized properties became popular in the 1990s and early 2000s, but buyer preferences have shifted dramatically toward smaller, more efficient living spaces.

Younger buyers especially don’t want the high utility bills and endless maintenance that come with 4,000+ square foot homes. Energy costs keep climbing, making these houses expensive to heat during brutal Illinois winters.

Many McMansions also feature poor-quality construction hidden behind impressive facades. When repair bills start piling up alongside property taxes, homeowners often struggle to find buyers willing to take on such financial burdens, pushing values downward steadily.

2. Homes Near Closed Manufacturing Plants

Did you know that Illinois has lost over 300,000 manufacturing jobs since 2000? When factories close, entire neighborhoods feel the impact almost immediately. Homes located within a few miles of shuttered plants typically see values drop as employment opportunities vanish.

Without good jobs nearby, families move away to find work elsewhere. This creates a domino effect where local businesses close, schools lose funding, and crime rates sometimes increase.

I’ve seen communities where home prices fell 30-40% after a major employer left town. Banks become hesitant to lend in these areas, and selling becomes incredibly difficult. The economic ripple effects can last decades, making recovery uncertain for property values.

3. Properties With Outdated Galvanized Plumbing

How many home inspections fail because of old galvanized pipes? More than you’d think! These metal pipes were common before 1960 but corrode from the inside out over time. Buyers today know this means expensive replumbing jobs that can cost $8,000 to $15,000.

When pipes corrode, water pressure drops and discoloration becomes noticeable. Insurance companies sometimes refuse coverage or charge higher premiums for homes with galvanized plumbing.

Smart buyers will negotiate thousands off the asking price or simply walk away. Lenders also get nervous about financing homes with known plumbing issues. Unless you replace the entire system before selling, expect your home’s value to take a serious hit compared to updated properties.

4. Single-Family Homes in High-Tax Districts

Illinois has some of the highest property taxes in America, with certain districts charging over $10,000 annually on modest homes. When taxes consume a huge chunk of monthly housing costs, buyers naturally look elsewhere for better value.

Remote work has given families freedom to relocate to lower-tax states entirely. I’ve talked to sellers who can’t compete with neighboring towns that offer similar homes but substantially lower tax bills.

This creates downward pressure on home values in high-tax areas. Even if your home is beautiful and well-maintained, buyers calculate total ownership costs. When those numbers look scary compared to alternatives, your property sits on the market longer and sells for less than you hoped.

5. Condos in Struggling HOA Buildings

When HOA reserves run low and special assessments start hitting residents, condo values plummet fast. Buildings with deferred maintenance issues like aging roofs, crumbling parking structures, or outdated elevators become nearly impossible to sell.

Lenders scrutinize HOA finances carefully before approving mortgages. If reserves fall below recommended levels or too many units have delinquent fees, financing gets denied and your buyer pool shrinks dramatically.

I’ve watched units in troubled buildings lose 20% of their value within a year. Buyers fear surprise assessments that could cost thousands with little notice. Unless the HOA gets financially healthy quickly, individual unit values will keep dropping regardless of interior upgrades owners make.

6. Ranch Homes Without Open Floor Plans

It’s amazing how much home design preferences have changed! Ranch homes with multiple small, separated rooms feel cramped and dark to modern buyers. Today’s families want open concepts where kitchens flow into living areas for entertaining and family interaction.

Walls that chop up space make homes feel smaller than their actual square footage. Natural light gets blocked, creating a cave-like atmosphere nobody wants anymore.

Renovating to open floor plans costs $15,000 to $50,000 depending on whether walls are load-bearing. Most buyers won’t pay premium prices for homes needing major layout changes. Your traditional ranch will likely sell below market value unless you invest in modernizing the floor plan before listing.

7. Homes in Flood-Prone Areas

Though climate patterns are shifting, Illinois has experienced increased flooding events along rivers and low-lying areas. Properties in designated flood zones face mandatory flood insurance requirements that can cost thousands annually on top of regular homeowners insurance.

Buyers hesitate when they see flood zone designations on property disclosures. Even one flooding incident creates a permanent record that scares away potential purchasers.

Banks also limit lending in high-risk flood areas or require larger down payments. Resale values drop significantly because your buyer pool shrinks to cash buyers or those willing to accept the risks. FEMA keeps updating flood maps, and properties that weren’t previously at risk sometimes get added, instantly affecting values.

8. Properties With Knob-and-Tube Wiring

Are you aware that many insurance companies refuse to cover homes with knob-and-tube wiring? This outdated electrical system from the early 1900s poses serious fire hazards because it lacks grounding and can’t handle modern electrical loads safely.

Home inspectors flag this issue immediately, and buyers rightfully demand either rewiring before closing or massive price reductions. Complete rewiring costs $8,000 to $15,000 for average-sized homes.

Without insurance coverage, buyers can’t get mortgages, limiting your market to cash purchasers only. Even those willing to buy will negotiate aggressively since they know about the safety risks and upcoming expenses. Your home will sit on the market much longer and sell for considerably less than comparable properties with updated electrical systems.

9. Luxury Homes in Rural Illinois Counties

Luxury properties in sparsely populated rural counties face a tough reality: very few qualified buyers exist locally. When you build or buy a $500,000+ home in an area where median income is $45,000, finding someone who can afford it becomes extremely challenging.

Wealthy buyers typically prefer luxury homes near urban amenities, cultural attractions, and quality schools. Remote locations lack these draws no matter how beautiful the property itself might be.

I’ve seen stunning rural estates sit unsold for years, eventually selling at 30-40% below their original asking prices. The market for high-end rural properties is incredibly thin, and economic uncertainty makes it even worse. Unless you’re willing to wait indefinitely, expect significant value losses.

10. Split-Level Homes From the 1970s

Remember when split-level homes seemed like the perfect solution for sloped lots? That popularity has faded dramatically as buyers now view the multiple staircases as inconvenient and problematic for aging homeowners or those with mobility issues.

The chopped-up layout feels disjointed compared to modern open designs. Heating and cooling these homes efficiently proves difficult because of the staggered levels and poor insulation typical of 1970s construction.

Millennials and Gen Z buyers strongly prefer single-level living or traditional two-story layouts instead. Unless your split-level has been extensively renovated with modern finishes, it’ll likely sell below comparable ranch or two-story homes. The architectural style simply doesn’t align with current buyer preferences anymore.

11. Homes Backing Onto Commercial Properties

If your backyard view includes loading docks, dumpsters, or parking lots, you’re already fighting an uphill battle for value retention. Homes adjacent to commercial properties suffer from noise pollution, lighting issues, and zero privacy in outdoor spaces.

Families with children avoid these properties because backyards feel unsafe and unpleasant. Delivery trucks, employee conversations, and business operations create constant disturbances that destroy the peaceful home environment buyers expect.

Even commercial properties that seem quiet now could expand operations or change ownership, bringing new problems. Buyers recognize these risks and discount offers accordingly. Comparable homes in purely residential neighborhoods will always command higher prices, leaving your property trailing behind in value.

12. Fixer-Uppers Requiring Major Systems Replacement

When furnaces, air conditioners, roofs, and water heaters all need replacement simultaneously, you’re looking at $25,000 to $50,000 in immediate expenses. Today’s buyers prefer move-in ready homes rather than renovation projects requiring huge upfront investments.

HGTV shows made flipping look easy, but reality involves permits, contractors, and unexpected problems that drain budgets quickly. Most people lack the cash reserves or energy for major renovations.

Banks also hesitate to finance homes needing substantial work, further limiting your buyer pool. Properties requiring multiple system replacements typically sell to investors at deeply discounted prices. Unless you complete the major updates yourself before listing, expect offers far below what similar updated homes command in your neighborhood.

13. Properties Near Superfund Sites

How would you feel knowing your dream home sits near a federally designated contaminated site? The EPA lists several Superfund locations across Illinois where toxic materials require long-term cleanup efforts spanning decades.

Even if contamination doesn’t directly affect your property, proximity creates stigma that tanks property values. Buyers worry about health risks, groundwater contamination, and future liability issues that could arise.

Disclosure laws require sellers to inform buyers about nearby environmental hazards. Once people learn about Superfund sites within a mile or two, most walk away immediately. Those willing to consider the property demand steep discounts. Values in these areas consistently underperform compared to similar neighborhoods without environmental concerns hanging overhead.

14. Investment Properties in Declining Rental Markets

Certain Illinois cities are experiencing population decline, creating oversupplied rental markets where vacancy rates climb and rents stagnate or fall. Investment properties that once generated positive cash flow now struggle to cover mortgages and expenses.

When renters have abundant choices, landlords must lower rents or offer concessions to fill units. Property values for rental buildings directly correlate with income potential.

I’ve watched investors lose money monthly on properties they can’t sell without taking huge losses. Banks appraise rental properties based on income generation, so declining rents mean declining values automatically. Unless the local economy rebounds with new job creation and population growth, these investment properties will continue losing value throughout 2026 and beyond.