13 Homes Losing Value Fast Especially In Florida And Nevada

The housing market can be as unpredictable as a game of cards, with certain properties folding faster than others.

Right now, specific types of homes in Florida and Nevada are seeing their values plummet at alarming rates.

Whether you’re looking to buy, sell, or simply stay informed about real estate trends, understanding which properties are losing value can help you make smarter decisions with your money.

1. High-Rise Beach Condos

Once the crown jewels of coastal skylines, high-rise beach condos in Miami and Panama City are now bleeding value. Insurance premiums have skyrocketed after recent hurricanes, making monthly costs unbearable for many owners.

Maintenance fees keep climbing too, with some buildings charging special assessments that reach tens of thousands of dollars for structural repairs. Older buildings face the worst decline, especially those built before 2000.

Many investors who snatched up these properties during the boom years are now desperate to sell, creating a buyer’s market where patience pays off. With climate change concerns growing, these vertical vacation homes may continue their downward spiral.

2. Waterfront Luxury Estates

Million-dollar waterfront mansions in Naples and Lake Las Vegas are watching their values wash away faster than their eroding shorelines. Rising flood insurance rates have become budget-busters, with some premiums jumping 300% in just two years.

These massive properties also face increasing maintenance costs as extreme weather batters expensive docks, seawalls, and landscaping. Wealthy buyers are increasingly hesitant about properties vulnerable to storm surge or drought conditions.

The ultra-luxury market segment has become particularly soft as foreign investors pull back from American real estate. Properties that sold for $5 million in 2021 are now languishing on the market at $3.5 million with no takers.

3. Gated Golf Community Homes

If you bought a home in a golf community thinking it was a hole-in-one investment, recent trends might leave you in the rough. These once-prestigious properties in places like Palm Beach and Henderson are seeing values slice dramatically downward.

Younger homebuyers simply aren’t interested in paying hefty HOA fees for golf amenities they rarely use. Many communities are struggling with aging courses that require expensive renovations, passing costs to homeowners through special assessments.

Water scarcity in Nevada has made maintaining lush fairways increasingly expensive and environmentally questionable. Some communities have seen values drop 15-20% as courses close entirely, replacing that pristine golf view with weedy, abandoned land.

4. Desert Mega Mansions

Las Vegas mega mansions built during the early 2000s boom are now selling for fractions of their construction costs. These sprawling desert palaces, often exceeding 10,000 square feet, have become white elephants in today’s market.

Soaring energy costs make cooling these massive structures increasingly expensive, with monthly utility bills often exceeding $2,000 during summer months. Their flashy, dated aesthetics – think Roman columns, massive chandeliers, and gold-plated fixtures – appear tacky to younger buyers who prefer modern, minimalist designs.

Water restrictions have killed off elaborate landscaping schemes, leaving once-lush properties looking barren. The remote locations of many of these mansions, once touted as exclusive, now feel inconveniently isolated as buyers prioritize walkable neighborhoods.

5. Large Vacation Rentals

Those massive vacation rental properties that promised hefty returns are now hemorrhaging value, especially in oversaturated markets like Orlando and Lake Tahoe. Stricter local regulations have crippled many short-term rental businesses, with some communities banning them entirely.

Competition has become fierce as everyone and their brother jumped into the vacation rental market post-pandemic. Properties that once commanded $400 nightly now struggle to book at half that rate.

Mortgage rate increases have doubled monthly payments for many investors who purchased at peak prices with adjustable loans. Maintenance costs for these large properties eat away at diminishing returns, creating a perfect storm that’s sending values plummeting by 25% or more in some areas.

6. Coastal Stucco Villas

Mediterranean-style stucco villas that once dominated Florida’s Gulf Coast are watching their values crumble faster than their exterior finishes. These homes, typically built in the 1990s and 2000s, face serious structural and aesthetic challenges in today’s market.

Stucco repair costs have skyrocketed, with full remediation often exceeding $100,000 when water intrusion has caused hidden damage. Their ornate, busy styling feels dated to younger buyers who prefer clean, contemporary lines.

Many of these properties were constructed in flood-prone areas that now face insurance nightmares. The terracotta tile roofs that define this style require expensive replacement after about 20 years – a cost many current owners can’t afford, leading to desperate sales at reduced prices.

7. Overbuilt Custom Homes

Those massive custom-built showplaces in Henderson and Boca Raton are proving that bigger isn’t always better when it comes to resale value. These personalized palaces, often built without concern for future marketability, are now selling at steep discounts.

Homes with bizarre floor plans, overly specific custom features, or unusual themes appeal to an extremely limited buyer pool. One Henderson property with an indoor basketball court and four-story waterslide recently sold for 40% below its construction cost.

Energy efficiency is another major concern, as these older custom homes typically lack modern insulation and HVAC systems. Specialized maintenance requirements for features like elaborate water features, custom lighting systems, or imported materials further depress values as practical buyers calculate the true cost of ownership.

8. Aging Senior Communities

The retirement paradises that attracted snowbirds to Florida and Nevada decades ago are facing serious value declines as their aging infrastructure crumbles. Communities built in the 1970s and 1980s now struggle with outdated amenities and mounting repair bills.

Demographic shifts play a huge role too – as original owners pass away, there simply aren’t enough seniors interested in these dated communities to maintain demand. Clubhouses with formal dining rooms and card lounges don’t appeal to today’s active retirees who want modern fitness centers and coffee shops.

HOA financial troubles compound the problem when reserves prove inadequate for major repairs. In some communities near Fort Myers and Sun City, properties that sold for $250,000 five years ago now struggle to fetch $180,000, even in this seller’s market.

9. Timeshare Properties

Timeshare units in Orlando and Las Vegas have become notorious for their rapid depreciation, often losing 70% of their value the moment the ink dries on the purchase contract. These fractional ownership properties continue their downward spiral year after year.

Annual maintenance fees increase relentlessly, often rising 5-8% yearly regardless of usage or property improvements. Many owners discover they can rent equivalent accommodations for less than their maintenance fees, making ownership financially irrational.

The resale market is flooded with desperate sellers willing to accept pennies on the dollar just to escape ongoing fees. Some owners even pay companies thousands of dollars to take these properties off their hands. With younger travelers preferring the flexibility of Airbnb and hotel loyalty programs, the future looks bleak for timeshare valuations.

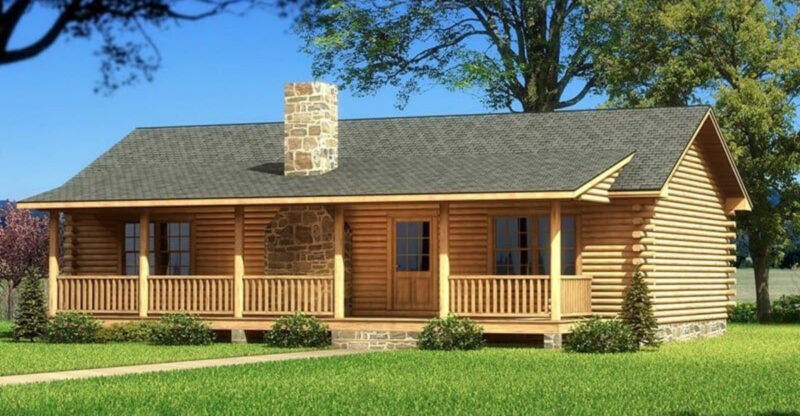

10. Remote Desert Cabins

Those rustic getaways in Nevada’s remote desert regions have lost their appeal faster than water evaporates in the summer heat. Properties in areas like Pahrump and Mesquite are seeing values crater as practical concerns outweigh romantic notions of desert living.

Water scarcity has become a critical issue, with some properties requiring expensive water deliveries or dealing with wells that produce increasingly mineralized water. Extreme heat makes these properties uninhabitable without costly cooling systems during summer months.

Rising fuel prices have made the long commutes to amenities and services prohibitively expensive. Fire insurance has become either astronomically expensive or completely unavailable in many areas, further depressing values. What once seemed like an affordable slice of solitude now represents a financial burden many owners are desperate to unload.

11. Large Suburban Houses

McMansions in the suburbs of Jacksonville and Henderson are facing a serious market correction as buyer preferences shift dramatically. These 4,000+ square foot homes on quarter-acre lots are increasingly seen as white elephants by younger buyers.

Heating and cooling costs for these oversized properties have become budget-busters as energy prices climb. Their location in car-dependent suburbs has become less attractive as gas prices rise and work-from-home buyers prioritize walkable neighborhoods with character.

The formal living rooms, dining rooms, and bonus spaces that justified these homes’ size now feel wasteful to minimalist-minded millennials. Many feature dated finishes that require expensive updates – think granite countertops, cherry cabinets, and beige everything. Some neighborhoods have seen average values drop 15-20% while smaller, more efficient homes hold steady.

12. Old Spanish-Style Villas

Spanish revival homes built in the 1920s-1940s in places like Coral Gables and Las Vegas are losing their premium status in today’s market. Despite their historical charm, these properties face serious practical challenges that are driving values downward.

Original plumbing and electrical systems require complete modernization, often costing $75,000 or more. The small closets, compartmentalized floor plans, and tiny kitchens don’t match how people live today.

These homes typically lack proper insulation, making them energy inefficient and uncomfortable in extreme weather. Authentic restoration materials have become prohibitively expensive, forcing compromises that purists view as destroying character. While these homes once commanded premium prices for their unique architecture, younger buyers increasingly view them as money pits requiring endless renovation.

13. Water-Dependent Properties

Homes designed around artificial water features in desert communities like Henderson and drought-prone areas of Florida are watching their values evaporate. Properties surrounding man-made lakes, extensive pool complexes, or decorative water features face mounting challenges.

Water restrictions have left many artificial lakes and ponds at record low levels or completely dry. Maintaining these features has become prohibitively expensive as water prices soar in response to ongoing drought conditions.

Buyers have grown increasingly concerned about the environmental sustainability and long-term viability of these water-dependent communities. In some developments, homes that marketed their waterfront views as primary selling points have lost 30% of their value as those features deteriorate. The paradise promised in the brochures has become a costly maintenance nightmare that fewer buyers are willing to take on.