12 Arizona Homes Facing Market Challenges

The Arizona housing market is hitting some bumps in the road. From Phoenix’s sweltering suburbs to Tucson’s desert landscapes, homeowners are dealing with issues that make selling tough.

I’ve noticed several properties struggling to find buyers despite Arizona’s reputation as a hot real estate destination. Let’s look at some real examples of homes facing uphill battles in today’s market.

1. Outdated Ranch in Scottsdale

Walking through this 1970s ranch home feels like stepping into a time capsule. The original shag carpeting and wood paneling might have been stylish fifty years ago, but today’s buyers want modern touches.

The owners have lived here for decades and struggle to understand why their beloved home isn’t selling. They’ve already dropped the price twice. Without significant renovations to bring this property into the 21st century, it may continue sitting on the market for months to come.

2. Flood-Prone Property in Tempe

Recent monsoon seasons have been particularly cruel to this otherwise charming bungalow near Tempe Town Lake. The basement has flooded three times in five years, creating ongoing moisture issues that scare away potential buyers.

Insurance rates for this property have skyrocketed, adding another layer of difficulty to the sale. Even with professional remediation and new sump pumps installed, the home’s history of water damage follows it like a shadow, reflected in inspection reports that make buyers flee.

3. Solar Panel Nightmare in Mesa

You might think solar panels would be a selling point in sunny Arizona. Not for this Mesa property! The owners signed a 25-year lease for their rooftop solar system, creating a complicated legal situation for any buyer.

The monthly lease payments actually exceed the energy savings, turning what should be an eco-friendly asset into a financial liability. Potential buyers keep walking away once they understand they’d need to take over this underwater contract or pay a massive buyout fee. The sellers never imagined their green decision would become such a roadblock.

4. High-Rise Condo with HOA Troubles

From the 14th floor, the views of downtown Phoenix are breathtaking. Unfortunately, the building’s financial situation is equally jaw-dropping – for all the wrong reasons. This luxury condo sits in a building with serious HOA problems.

A recent special assessment hit owners with a $15,000 bill for facade repairs. Rumors of another assessment for elevator modernization have scared off interested buyers. The current owner has already moved out of state and feels trapped paying the mortgage plus rising HOA fees for a property he can’t unload.

5. Power Line Eyesore in Chandler

Built in a developing area of Chandler, this family home had unobstructed desert views when purchased five years ago. Everything changed when the city installed massive power transmission lines directly behind the property last year.

Besides being visually unappealing, many potential buyers worry about potential health effects. The constant buzzing noise doesn’t help either. Though priced well below comparable homes in the neighborhood, showings rarely lead to offers. The owners never imagined infrastructure development would tank their property value so dramatically.

6. Landlocked Lot in Sedona

Nestled among Sedona’s famous red rocks, this stunning custom home should be a hot commodity. The catch? You can only reach it by driving across a neighbor’s property on an informal easement that was never properly documented.

The current owners have maintained friendly relations with the neighbor, but potential buyers see a major legal headache waiting to happen. What if the neighbor decides to block access? Legal costs to establish a permanent easement could run into tens of thousands. Even priced $100,000 below market value, this access issue continues deterring serious offers.

7. Crime-Affected Neighborhood in Glendale

The home itself is a perfectly maintained three-bedroom with recent upgrades and a beautiful pool. Location, however, proves to be its downfall. A recent spike in break-ins and car thefts has given this Glendale neighborhood an unfortunate reputation.

Online crime maps highlight the area in alarming red, sending potential buyers running. The sellers have installed a comprehensive security system and even offer to prepay a year of monitoring service. Despite these efforts and a price well below market value, families with children particularly avoid scheduling showings.

8. Foundation Problems in Flagstaff

Northern Arizona’s dramatic temperature swings have wreaked havoc on this Flagstaff home’s foundation. Cracks snake across the walls, and doors throughout the house no longer close properly. The shifting foundation has created visible slopes in some floors.

Three different contractors have provided repair estimates ranging from $45,000 to $78,000. The current owners can’t afford these repairs, but buyers aren’t willing to take on such a massive project. Even priced as a fixer-upper, the foundation issues scare away most potential buyers who fear even more problems might be hiding.

9. Former Meth Lab in Tucson

You’d never guess this charming Tucson bungalow’s troubled past from its fresh paint and new landscaping. Unfortunately, public records tell the story: the property was once a methamphetamine production site.

Though professional remediation was completed years ago and the home meets all safety standards, the stigma remains. Arizona disclosure laws require sellers to inform potential buyers about this history. Most families immediately lose interest upon hearing this information, despite the attractive price point and desirable neighborhood. The current owners, who purchased at a steep discount, now face the same stigma challenge.

10. Airplane Noise Nightmare in Gilbert

When this Gilbert subdivision was built ten years ago, the regional airport was small and rarely used. Today, flight patterns have changed, and air traffic has increased dramatically, with planes now roaring overhead every few minutes.

Inside this otherwise lovely home, conversations pause regularly for passing aircraft. Sleeping with windows open is impossible. The sellers have installed triple-pane windows and additional insulation in the attic, making only modest improvements. Despite being priced 15% below similar homes in quieter neighborhoods, interested buyers quickly lose enthusiasm during showings when planes interrupt the tour.

11. Water Shortage Issues in Prescott

Perched on a hillside with magnificent views, this Prescott property looks like a dream home. The nightmare? It relies on well water in an area where the water table has dropped dramatically in recent years.

Neighbors have already had to drill deeper wells at considerable expense. The current well produces barely enough water for a couple, making the home impractical for families. Installing rainwater collection systems might help, but the upfront costs are substantial. Even with a recent $50,000 price reduction, buyers remain hesitant about committing to a property with uncertain water future.

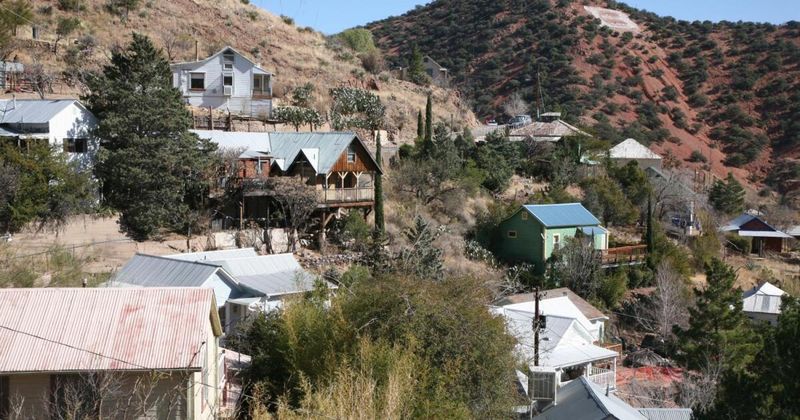

12. Mining Subsidence Risk in Bisbee

This historic miner’s cottage in Bisbee oozes charm with its original details and stunning mountain views. What lies beneath creates serious buyer hesitation: the home sits above abandoned mining tunnels with increasing subsidence risk.

Recent geological surveys have identified several nearby properties with shifting foundations due to underground collapse. Insurance companies now require expensive riders to cover potential subsidence damage. The current owners have reduced the price three times but continue receiving the same feedback—buyers love the house but fear the ground beneath it. This mining town heritage has become a modern liability.