5 Types Of Homes In Hawaii With Potential Value Declines

Hawaii’s real estate market has long been a dream for many investors and homeowners. But changing climate conditions, economic shifts, and evolving buyer preferences are creating new risks for certain property types across the islands.

Understanding which homes might face value challenges can help current owners and potential buyers make smarter decisions about their Hawaiian real estate investments.

1. Oceanfront Properties in Erosion Zones

Those pristine beachfront homes with waves practically lapping at their lanais face an uncertain future. Rising sea levels and increasingly severe coastal erosion are literally washing away the land beneath many oceanfront properties, especially on islands like Oahu and Maui.

Insurance companies have taken notice, with many now refusing coverage or charging astronomical premiums for homes in high-risk erosion zones. Without adequate insurance, these once-premium properties become nearly impossible to sell at their former values.

2. Luxury High-Rise Condos in Urban Honolulu

The gleaming towers of Kakaako and Ala Moana that once commanded top dollar are showing signs of market vulnerability. Overbuilding in these neighborhoods has created a supply glut that’s putting downward pressure on values, especially for units without exceptional views or amenities.

Remote work trends have also diminished the appeal of urban living for many buyers who now prioritize space over location. Add in rising maintenance fees and special assessments for aging buildings, and these once-hot investments may cool considerably in coming years.

3. Homes in Lava Flow Hazard Zones

Living near Kilauea might offer spectacular views, but the 2018 eruption was a harsh reminder of the risks. Properties in high-risk lava zones on the Big Island face ongoing uncertainty that’s reflected in their market values and insurability.

What makes these properties particularly vulnerable isn’t just the direct threat of destruction. The psychological impact of the last major eruption continues to influence buyer behavior, with many now avoiding these areas entirely. When insurance companies designate a property as high-risk, obtaining affordable coverage becomes nearly impossible.

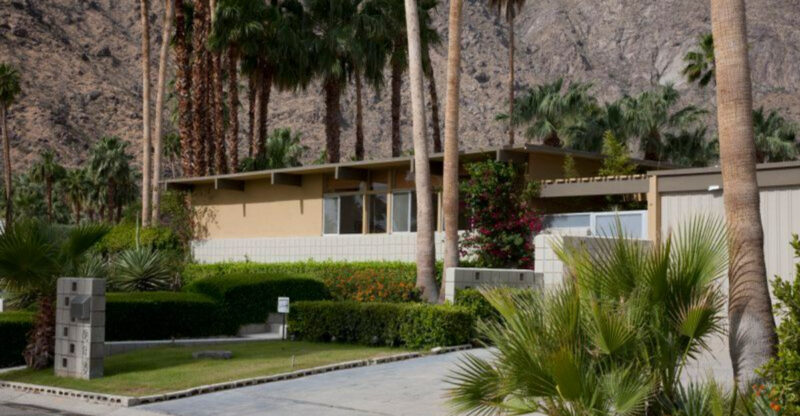

4. Aging Plantation-Style Homes with Deferred Maintenance

The charming wooden plantation homes that dot the Hawaiian landscape face a perfect storm of challenges. Their single-wall construction makes them particularly vulnerable to termites, moisture damage, and tropical storms – issues that compound over time and become increasingly expensive to address.

Modern buyers often balk at the renovation costs these properties require. Stricter building codes mean that significant renovations can trigger requirements for complete structural upgrades, turning what might seem like a reasonable fixer-upper into a financial nightmare.

5. Vacation Rentals in Over-Regulated Areas

Those cute cottages and condos that once generated steady income as vacation rentals are losing their investment appeal fast. Counties across Hawaii have implemented increasingly strict regulations on short-term rentals, with some areas banning them entirely outside resort zones.

Properties purchased specifically for vacation rental income may see significant value drops as their income potential disappears. Many owners now face the difficult choice of converting to long-term rentals at much lower returns or selling into a market where their property’s primary selling point no longer exists.