7 Antiques Increasing In Value In New York And 7 That May Be Less In Demand

The antiques market in New York City constantly shifts with changing tastes and trends. What was hot last season might be gathering dust today, while yesterday’s forgotten treasures suddenly command premium prices. Smart collectors and dealers know that timing is everything in this fast-paced market.

Understanding which antiques are gaining value and which are losing appeal can make the difference between a savvy investment and a costly mistake.

1. Mid-Century Modern Furniture

Clean lines and functional design from the 1950s and 60s continue captivating New York’s elite collectors. Pieces by designers like Eames, Saarinen, and Noguchi regularly fetch five-figure sums at Manhattan auctions, with prices climbing roughly 15% annually.

Original condition matters tremendously in this market. Even minor repairs can slash values dramatically, so pristine examples command substantial premiums.

The appeal crosses generational lines – baby boomers buy for nostalgia while millennials appreciate the aesthetic that pairs perfectly with urban apartments. Danish teak pieces particularly outperform expectations as buyers recognize their superior craftsmanship.

2. Art Deco Jewelry

Geometric patterns and bold designs from the 1920s and 30s have recaptured New York’s imagination. Pieces featuring platinum settings with diamonds and colored gemstones are especially coveted, with some exceptional examples doubling in value over just three years.

Signed pieces from iconic houses like Cartier, Tiffany, and Van Cleef & Arpels command the highest premiums. Even unsigned examples with quality craftsmanship perform exceptionally well in the current market.

Manhattan’s elite have embraced these statement pieces for gala events, creating ripple effects throughout the market. The clean lines complement contemporary fashion while offering historical significance that new jewelry cannot match.

3. Vintage Watches

Mechanical timepieces from prestigious makers have become Manhattan’s ultimate status symbol. Vintage Rolex, Patek Philippe, and Omega watches regularly outperform traditional investments, with rare models appreciating 20-30% annually in the New York market.

Condition matters, but unlike many collectibles, watches with signs of gentle aging often command premiums. Collectors call this desirable patina, particularly valuing tropical dials that have faded to warm brown hues.

Original boxes and papers multiply value substantially. Wall Street executives and tech entrepreneurs drive much of this demand. Even entry-level vintage timepieces now regularly exceed $5,000.

4. Chinese Export Porcelain

Once overlooked by serious collectors, 18th and 19th century porcelain made specifically for Western markets has surged in popularity. Blue and white pieces featuring American historical scenes or New York landmarks command exceptional premiums, often selling within hours of appearing in Manhattan galleries.

Chinese-American collectors have significantly influenced this market, seeking to reclaim cultural heritage while making sound investments. Pieces with documented provenance from notable New York families can fetch triple the prices of similar items without such history.

Condition standards remain stringent – even hairline cracks can reduce values by 70%. The most desirable pieces combine technical excellence with artistic merit and historical significance, creating the perfect collecting trifecta.

5. Vintage Photography

Original prints by renowned photographers have skyrocketed in value across New York galleries. Images of historic Manhattan by Berenice Abbott or Weegee routinely sell for five-figure sums, while works by masters like Richard Avedon continue breaking auction records.

Authentication proves crucial in this market. Provenance, signatures, and proper documentation make enormous differences in valuation, with Manhattan dealers developing sophisticated verification techniques.

Museum exhibitions drive tremendous interest in specific photographers. When MoMA or the Whitney features an artist, values for their works often surge 40% within months. Black and white street photography particularly resonates with collectors.

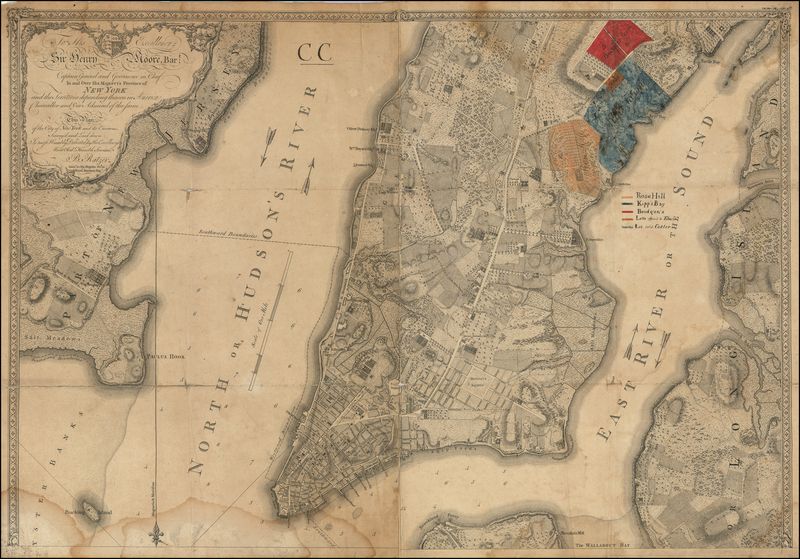

6. Antique Maps

Early maps of Manhattan and surrounding boroughs have become white-hot collectibles. Hand-colored examples from the 17th and 18th centuries regularly fetch five-figure sums, with particularly rare or historically significant maps selling for over $100,000 at specialized New York auctions.

Condition standards have relaxed somewhat as collectors recognize the extreme rarity of pristine examples. Minor repairs or conservation work no longer dramatically impacts value when the map itself has historical importance.

Wall Street executives and real estate moguls drive much of this market, displaying these cartographic treasures in corner offices and luxury penthouses. Maps showing the evolution of specific neighborhoods or landmarks generate particular excitement among buyers with connections to those areas.

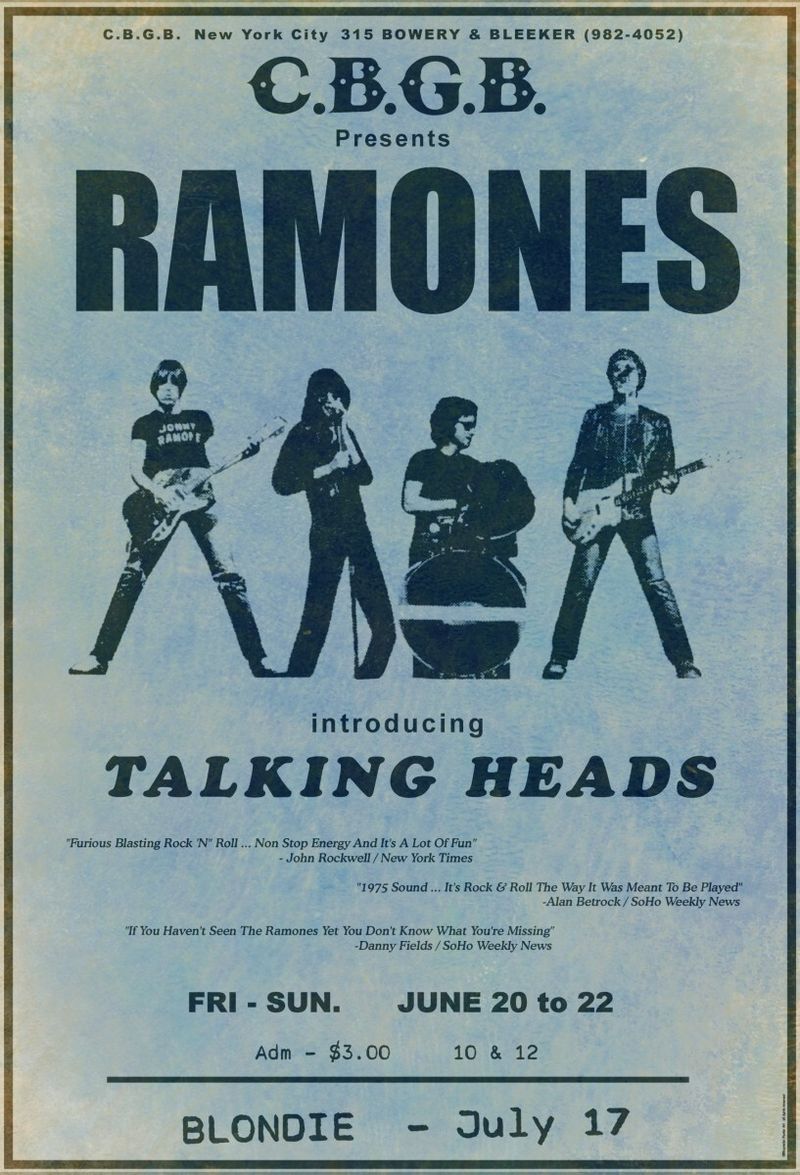

7. Vintage Concert Posters

Original posters from legendary New York venues like CBGB, the Fillmore East, and Madison Square Garden have exploded in value. Pieces advertising iconic performances by the Velvet Underground, Ramones, or Talking Heads regularly command four-figure prices, with rarities reaching $20,000+.

Condition proves crucial in this niche. Even minor tears or tape marks can significantly impact value, with near-mint examples fetching multiples of what damaged pieces bring.

Authentication expertise has developed as forgeries flood the market. Serious collectors rely on paper analysis, printing techniques, and provenance verification before making significant purchases.

8. Victorian Furniture

Heavy, ornate pieces that dominated upscale homes a century ago struggle to find buyers in today’s market. Massive sideboards, bedroom suites, and dining tables that once commanded premium prices now sell for fractions of their former values, with many failing to meet minimum reserves at New York auctions.

Space constraints in Manhattan apartments contribute significantly to this decline. Modern buyers simply lack room for these imposing pieces, preferring smaller-scale furniture that works in contemporary living situations.

Dark wood finishes and fussy ornamentation clash with today’s design preferences. Even well-preserved examples by notable makers struggle to find homes.

9. Hummel Figurines Tumble

Those charming German-made ceramic children that once filled curio cabinets across America have plummeted in value. Even rare examples struggle to command significant prices in the New York market, with many selling for less than 10% of their values from twenty years ago.

Changing demographics tell the story – primary collectors have aged out of the market, while younger generations show virtually no interest. Manhattan dealers report regularly declining consignments of even complete collections.

Market saturation compounds the problem. Mass production during their heyday means supply vastly exceeds demand. Only the rarest examples or those with unusual characteristics maintain any meaningful value.

10. Bradford Exchange Collector Plates

Limited edition commemorative plates that once promised investment potential now struggle to sell for even nominal amounts in New York shops. Complete sets in original boxes typically fetch less than $5 per plate regardless of their original issue price or supposed scarcity.

The market collapsed as collectors realized these mass-produced items were never truly rare. Despite marketing claims about limited production, millions were manufactured to meet artificial demand created by aggressive advertising.

Manhattan dealers often refuse these outright, knowing they’ll consume valuable shelf space indefinitely. Online marketplaces show thousands listed with minimal bids. The few buyers remaining are primarily seeking specific nostalgic images.

11. Thomas Kinkade Prints

Self-proclaimed “Painter of Light” Thomas Kinkade produced countless prints that once adorned suburban homes nationwide. Today, these mass-produced images struggle to find buyers at any price point in New York’s sophisticated art market.

Authentication certificates and numbered editions provide virtually no value enhancement. Even pieces marketed as “Master Edition” or with similar premium designations typically sell for less than their framing costs when they sell at all.

Manhattan dealers report these as among their most difficult items to move. The saccharine cottages and idealized landscapes simply don’t align with contemporary aesthetic preferences.

12. Precious Moments Figurines

Teardrop-eyed porcelain figurines that once commanded collector frenzy now sit unloved on New York thrift store shelves. Values have collapsed so dramatically that pieces originally selling for hundreds now struggle to fetch even $10 in Manhattan’s secondary market.

The saccharine aesthetic fails to resonate with younger buyers. Meanwhile, original collectors increasingly downsize, flooding the market with unwanted inventory. Even limited editions or retired pieces barely command premiums.

Condition matters little in this depressed market – mint examples in original boxes often sell for the same prices as damaged pieces. New York dealers increasingly refuse consignments entirely.

13. Beanie Babies Bubble

Remember when these small stuffed animals were projected to fund college educations? Today, even rare examples with tags intact typically sell for less than their original retail prices in New York’s collector markets.

The speculative bubble that once drove five-figure sales has thoroughly collapsed. Manufactured scarcity through “retirements” and “limited editions” created artificial demand that proved unsustainable once collector enthusiasm waned.

Manhattan dealers report regularly turning away entire collections. Only a handful of truly exceptional examples like authenticated factory errors or genuine prototypes retain significant value.

14. Norman Rockwell Collector Plates

Once marketed as heirloom investments, these mass-produced plates featuring Rockwell’s iconic Americana now languish in New York’s secondary market. Complete sets in original boxes typically sell for less than $10 per plate – a fraction of their original issue prices.

The collapse mirrors broader trends in mass-marketed collectibles. Despite claims of limited production, these were manufactured in enormous quantities to meet artificial demand created by sophisticated marketing campaigns.

Manhattan dealers frequently decline these consignments entirely. When they do accept them, they typically languish for months or years before selling at deeply discounted prices.