8 Types Of Las Vegas Homes Facing Potential Price Declines By 2026

Las Vegas real estate has long mirrored the city itself – glamorous, fast-moving, and unpredictable. Booms have given way to corrections before, and the latest signals suggest another adjustment may be on the horizon.

Rising costs, stricter rules, and environmental pressures are already reshaping demand, leaving certain types of homes more exposed than others. In a market built on ambition and reinvention, not every property is positioned to hold its value when the momentum shifts.

1. Luxury High-End Homes In Oversupplied Areas

Sprawling mansions with infinity pools and mountain views are losing their exclusivity as developers continue building in premium neighborhoods like The Ridges and MacDonald Highlands.

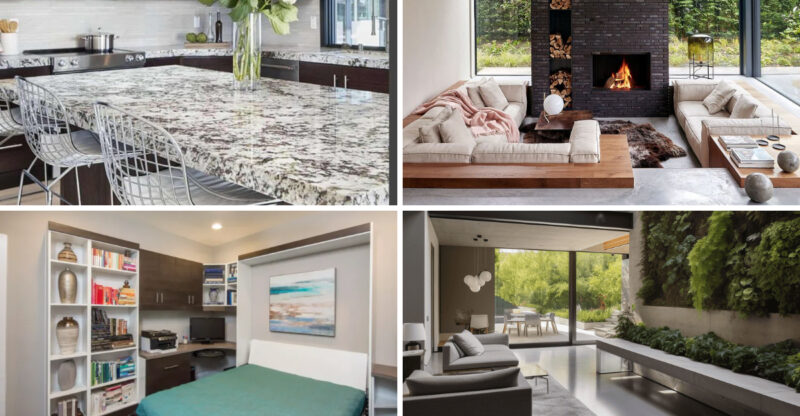

When too many luxury options flood the market, even the most opulent properties compete for a limited pool of wealthy buyers. These multi-million dollar estates, often customized with imported materials and smart-home technology, may see prices adjust to match actual demand.

2. Older Homes In Aging Subdivisions

Ranch-style houses built in the 1980s-90s throughout Henderson and North Las Vegas show their age against newer developments. Original kitchens, dated bathrooms, and older HVAC systems require significant investment, pushing buyers toward turnkey properties instead.

These established neighborhoods, once filled with families who stayed for decades, now compete with master-planned communities offering modern amenities and energy efficiency that today’s buyers prioritize.

3. Investor-Owned Short-Term Rental Properties

Vacation homes near the Strip purchased during the rental boom now face tightening regulations and increasing competition. Properties bought specifically for platforms like Airbnb have flooded certain zip codes, creating a saturated market where occupancy rates struggle to justify purchase prices.

These turnkey units, often featuring themed décor and hotel-like amenities, may hit the market simultaneously if investor profits continue declining under stricter HOA and city rules.

4. Waterfront Or Golf Course Homes Dependent On Scarce Resources

Desert oasis properties surrounding man-made lakes and lush golf courses command premium prices based on views that might not last. Drought conditions affecting Lake Mead highlight water scarcity issues that threaten the sustainability of water features and green spaces.

Homes in communities like Lake Las Vegas and Desert Shores, where residents pay extra for waterfront living, could see values adjust as environmental realities reshape these artificially verdant landscapes.

5. Suburban Tract Homes In Overbuilt Communities

Cookie-cutter houses in rapidly expanding areas like Centennial Hills and Inspirada offer similar layouts, finishes, and lot sizes across countless streets. When builders construct hundreds of nearly identical homes in quick succession, the uniqueness factor disappears, making resale challenging.

These neighborhoods, marketed for their affordability and community amenities, may see prices soften as developers continue launching new phases with competitive pricing and updated designs.

6. Condos In High Investor-Share Buildings

Sleek high-rise units near downtown and mid-rise complexes throughout the valley often have investor ownership rates exceeding 50%. Buildings dominated by rental units typically experience deferred maintenance, challenging HOA governance, and financing hurdles for potential buyers.

Appealing for their minimal upkeep and urban lifestyle, these lock-and-leave properties become vulnerable when multiple investors decide to exit the market simultaneously.

7. Mid-Tier Family Homes With High HOA Fees

Four-bedroom houses in gated communities throughout Summerlin and Green Valley offer comfortable living paired with escalating monthly costs. As homeowners association fees climb to maintain aging amenities like community pools, parks, and security features, the total ownership cost becomes burdensome.

These family-friendly properties, typically built between 2000-2010 with open floor plans and modest backyards, may see buyers hesitate when comparing monthly payments against newer homes with more reasonable fees.

8. Entry-Level Homes Purchased During Ealry 2020s

Starter homes in areas like Spring Valley and Sunrise Manor that changed hands during 2021-2022 commanded record prices amid frenzied bidding wars. Buyers who stretched their budgets and waived inspections to secure these properties may find themselves underwater as the market normalizes.

These modest homes, typically featuring 3 bedrooms and around 1,500 square feet, face potential value corrections as interest rates rise and pandemic-driven urgency fades from the market.