18 Things Appraisers Look For That Most Homeowners Miss

Getting your home appraised can feel like preparing for a pop quiz you didn’t study for. While you might think your house looks great, professional appraisers have a trained eye for details that most of us overlook.

These hidden factors can significantly impact your home’s value, sometimes by thousands of dollars. Understanding what appraisers notice might just help you maximize your property’s worth before that crucial evaluation.

1. Foundation Cracks That Tell Tales

Those tiny hairline cracks in your basement might seem insignificant, but appraisers spot them immediately. Small cracks could signal normal settling, while larger ones might reveal serious structural issues that could slash your home’s value.

Smart homeowners regularly inspect their foundations after heavy rains. Look for stair-step cracks in brick exteriors or horizontal cracks in basement walls. These are red flags that make appraisers nervous.

Foundation repairs aren’t cheap, but addressing minor issues before they worsen protects your investment long-term.

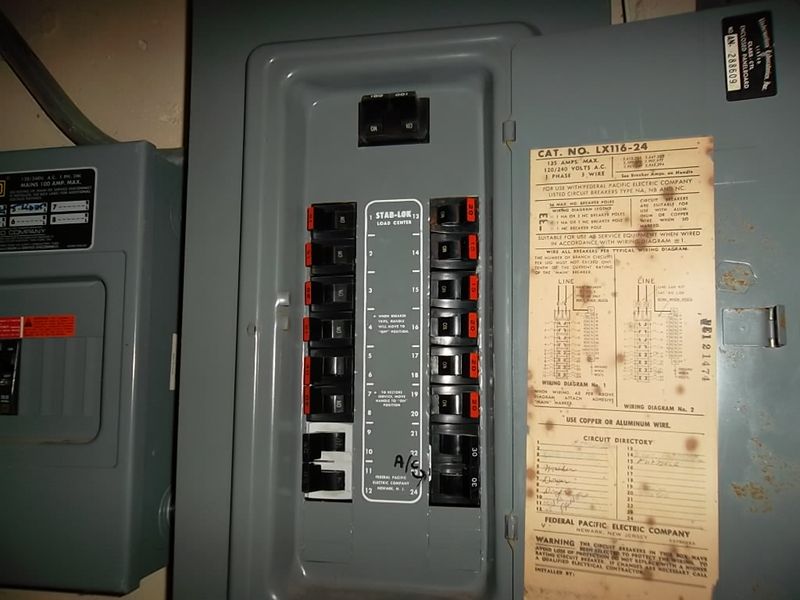

2. Outdated Electrical Panels

Your electrical panel might be hiding in plain sight, but appraisers never miss checking this critical component. Homes with outdated fuse boxes or panels under 100 amps face significant value reductions due to safety concerns and insurance complications.

Knob-and-tube wiring or aluminum wiring scream ‘fire hazard’ to professionals. These outdated systems often require complete replacement before some buyers can even secure financing.

Upgrading to a modern 200-amp panel not only improves your appraisal but also provides peace of mind regarding home safety.

3. Water Damage Whispers

Think a little water stain won’t make waves? Think again. Water leaves clues everywhere it flows, and appraisers are trained to sniff them out. Subtle ceiling stains, bubbling paint, or warped baseboards might seem harmless, but they scream “potential mold” louder than a dripping faucet.

Tempted to just brush it off with a coat of paint? Appraisers aren’t so easily fooled. They’ll dig deeper, checking for musty smells and poking around attics and crawlspaces, prime real estate for sneaky leaks.

Stop the drip drama before appraisal day. Fixing the source of water intrusion now helps your home stay high and dry on the value scale.

4. Roof Remaining Lifespan

Your roof silently ages until one day it demands tens of thousands to replace. Appraisers estimate remaining roof life through visible clues, curling shingles, missing granules, and even by checking attic ventilation quality.

While you might only notice a roof when it leaks, professionals can spot trouble years in advance. They’ll document the approximate age and condition, which directly impacts your home’s market value.

Homeowners benefit from annual roof inspections after storms. Simple maintenance like replacing damaged shingles can extend roof life and preserve your home’s appraised value.

5. HVAC System Efficiency

That noisy furnace in your basement isn’t just annoying, it’s a value indicator. Appraisers check the age, condition, and efficiency of heating and cooling systems since replacement costs can exceed $10,000.

Maintenance records matter tremendously here. A well-maintained 15-year-old system might be valued higher than a neglected 5-year-old unit showing signs of premature wear.

Regular professional servicing not only extends system life but also provides documentation that proves to appraisers you’ve been a responsible homeowner. This simple paper trail can preserve thousands in home value.

6. Window Functionality And Efficiency

Windows do more than frame your view, they reveal your home’s energy efficiency and maintenance level. Appraisers test whether windows open smoothly, check for failed seals (such as foggy glass), and note whether they’re single, or double-paned.

Condensation between glass panes signals broken seals that diminish insulation value. Painted shut windows reduce functionality and can be safety hazards that lower your home’s value.

Modern, energy-efficient windows can actually increase your home’s appraisal value beyond their installation cost. They enhance curb appeal and reduce energy expenses, two benefits that today’s buyers find especially attractive.

7. Plumbing System Health

Underneath your sinks lurks evidence that could sink your appraisal. Appraisers check water pressure, drainage speed, and inspect visible pipes for leaks or outdated materials like polybutylene that insurance companies hate.

They’ll run multiple faucets simultaneously to test system capacity. Slow drains, water hammer sounds, or rusty water are red flags that suggest expensive plumbing upgrades may be needed.

Homeowners often overlook minor leaks that create major moisture problems over time. That tiny drip under your kitchen sink might seem inconsequential but signals potential water damage that appraisers immediately document.

8. Floor Structure Stability

Is your floor throwing off your groove? The bounce in your step shouldn’t be coming from sagging boards. Appraisers have a feel for floors that dip, slope, or bounce, and to them, it often signals deeper trouble with joists or the foundation.

That little dip near the fridge, you’ve learned to live with? Appraisers won’t overlook it. Many will let the marble roll, literally, to test for hidden slopes you might not notice anymore.

Structural repairs aren’t cheap, but catching and correcting small issues early can save you from footing a much bigger bill (pun intended) down the line.

9. Grading And Water Drainage

Your yard’s slope matters more than its appearance. Appraisers check if ground slopes away from your foundation to prevent water intrusion. Improper grading that directs water toward your home predicts future foundation problems.

Pooling water near your foundation after rain is a major red flag. Smart homeowners address drainage issues with simple solutions like extended downspouts or French drains before water damages their biggest investment.

Even beautiful landscaping loses value if it creates drainage problems. Proper grading doesn’t have to sacrifice aesthetics, but must prioritize protecting your home’s structural integrity.

10. Functional Layout Flaws

That awkward bedroom you can only enter through another bedroom? Appraisers call it a functional obsolescence and it lowers value. They evaluate floor plan flow, noting outdated layouts like closed-off kitchens or bathrooms only accessible through bedrooms.

While you might have adapted to quirky layouts, buyers see inconveniences worth thousands less. Appraisers compare your home’s functionality to modern expectations, not what was acceptable when it was built.

Sometimes simple modifications can improve functionality dramatically. Removing a non-structural wall between kitchen and dining areas can transform an outdated layout into an open concept that appraisers value higher.

11. Garage Condition And Functionality

Garages aren’t just for cars anymore. Appraisers evaluate garage size, condition, and whether doors and openers function properly. A two-car garage that’s been converted to living space without permits might actually decrease your home’s value.

Garage door operation matters significantly. Doors that don’t open smoothly, lack modern safety features, or show significant wear indicate deferred maintenance that concerns appraisers.

Organization systems and finished walls can add value to this often-overlooked space. A clean, well-maintained garage suggests the rest of the home has received similar care.

12. Permits And Unpermitted Work

That beautiful basement finish might actually hurt your appraisal if done without permits. Appraisers cross-reference visible improvements with public records to identify unpermitted work that can drastically reduce value.

Finished basements, added bathrooms, or enclosed porches commonly lack proper permits. Though these improvements cost money, they might add zero value if not legally documented, or worse, require expensive corrections.

Residents should maintain a folder of all permits and approved inspections. This documentation proves work was done properly and allows appraisers to include these improvements in your home’s valuation.

13. Attic Insulation And Ventilation

Your attic reveals secrets about energy efficiency and potential moisture problems. Appraisers check insulation depth, distribution, and proper ventilation that prevents both heat loss and moisture buildup.

Inadequate attic ventilation leads to excessive heat that damages shingles from underneath and creates perfect conditions for mold growth. These issues might not be visible from your living space but significantly impact home longevity.

Upgrading attic insulation offers one of the best returns on investment for property owners. This relatively inexpensive improvement reduces energy costs and increases comfort while boosting your home’s appraised value.

14. Outdated Bathrooms And Kitchens

The avocado-green bathroom might be retro-cool to you, but it represents immediate renovation costs to appraisers. These high-function spaces receive extra scrutiny because they significantly impact resale value and buyer interest.

Beyond aesthetics, appraisers check for proper ventilation, water pressure, and signs of leaks or improper installation. They’ll note if fixtures and layouts meet current expectations or if they’re functionally obsolete.

Minor updates like new cabinet hardware, modern faucets, and fresh caulk around tubs can improve appearance without major renovation. These small investments often yield disproportionately positive impacts on appraised value.

15. Hidden Pest Damage

Tiny creatures can cause massive devaluation. Appraisers look for subtle signs of pest infestation that homeowners often miss, small wood piles near baseboards (termites), tiny holes in wooden structures, or soft spots in lumber.

Evidence of past water damage gets special attention since it creates perfect conditions for wood-destroying insects. Appraisers will tap suspicious areas, listening for the hollow sound that indicates damage beneath seemingly intact surfaces.

Regular pest inspections provide documentation that reassures appraisers. This preventative approach costs far less than addressing extensive damage that’s been allowed to progress unchecked for years.

16. Deferred Maintenance Patterns

What story is your home quietly telling? Small maintenance issues, like burnt-out bulbs, sticking doors, or dripping faucets, might seem minor, but appraisers see them as plot points in a tale of neglect.

Each little fix you’ve been meaning to get to adds up. To an appraiser, they suggest how well (or poorly) you’ve cared for your biggest investment, and hint at hidden problems lurking behind the walls.

The good news? Tackling these fixes before appraisal day is quick, affordable, and shifts the narrative. A well-oiled hinge and a working lightbulb go a long way in saying, “This home’s in good hands.”

17. Property Line Disputes

That fence your neighbor built might be secretly devaluing your property. Appraisers check for encroachments, structures that cross property lines, which can create title issues and reduce marketability.

Fences built inside your property line effectively give away land. Driveways, sheds, or landscaping that crosses boundaries creates complications that appraisers must document as potential legal liabilities.

Owners should verify property lines before making improvements near boundaries. A professional survey before building that new fence costs far less than resolving property disputes that can arise during sales transactions.

18. Curb Appeal First Impressions

Appraisers form opinions before entering your home. Peeling paint, overgrown landscaping, or cracked driveways create negative first impressions that color their entire evaluation.

While you might focus on interior improvements, exterior maintenance often delivers better value returns. Simple fixes like fresh mulch, trimmed shrubs, and power-washed siding can dramatically improve perceived home condition.

Appraisers compare your home’s exterior to neighborhood standards. A house that’s visibly neglected compared to neighbors will be valued lower, even if the interior is immaculate.